The Vintage Watch Boom: An Overview of Market Growth

Experiencing the Surge in Vintage Watch Investments

As leading experts dive deeper into the realm of fine jewelry and luxury timepieces, an inescapable trend emerges: the meteoric rise of the vintage watch market. The allure of investing in vintage high-end watches is not only about their timeless elegance but also their astounding market performance. According to a report by Art Market Research, vintage watches saw an average annual growth rate of 5-8% over the past decade, with some rare pieces achieving record-breaking auction sales.

The Underpinnings of the Vintage Watch Market Expansion

What fuels this vintage watch boom? The answer lies in a blend of scarcity, history, and craftsmanship. Vintage luxury timepieces, often handcrafted and produced in limited quantities, carry storied pasts that charm collectors and investors alike. With the increase in wealth among Millennial and Gen Z consumers, the demand for unique accessories like vintage watches grows stronger. The renowned watch trading platform Chrono24, for instance, experienced a 50% jump in vintage watch transactions in a single year, indicating a robust and thriving market.

The Role of Provenance in Valuing Vintage Timelessness

Provenance remains a critical factor in the valuation of vintage pieces. Watches owned by celebrities or featuring in significant historical events often fetch a premium. To illustrate, a vintage Rolex Daytona formerly owned by Paul Newman was auctioned for a staggering $17.8 million. Rarity and originality, such as watches with unaltered dials or original parts, also contribute substantially to value appreciation. Industry statistics reveal that rare vintage models from top brands like Rolex and Patek Philippe have escalated by over 200% in the past 20 years, outstripping many contemporary investments.

Digital Narratives Amplifying Vintage Desirability

Fascination with vintage watches is not simply about possession—it's about the stories that accompany them. Digital media has played a pivotal role in sharing these narratives, making vintage high-end watches more accessible and desirable to a broader audience. Influential collectors and celebrities often share their vintage treasures on social media, thereby inspiring an emerging group of enthusiasts and stimulating market growth. Notably, platforms dedicated to watch collecting, such as Hodinkee, amplify these tales, thereby weaving a digital tapestry that bolsters the vintage watch industry.

Comparing Eras: Vintage Versus Modern Luxury Timepieces

Decoding the Allure of Historical Timepieces versus Contemporary Designs

In the pursuit of high-end watches, connoisseurs are often met with a pivotal choice: invest in the storied craftsmanship of vintage watches or opt for the cutting-edge technology and design of modern luxury timepieces. Recent market analysis reveals a fascinating trend towards vintage watches, often due to their rarity and the storied past they encapsulate. According to the Knight Frank Luxury Investment Index, vintage watches have seen an appreciation of 5% in 12 months preceding June 2020, showcasing their robust investment potential.

- Exclusivity Factor - Vintage watches offer a slice of history and a story to tell, factors that are deeply appreciated by collectors globally.

- Innovation Significance - Modern timepieces often highlight technological advancement and pioneering materials, catering to a market seeking the latest functionalities and precision.

- Design Evolution - The aesthetic of watches has evolved significantly, with vintage pieces reflecting the design ethos of their era, which is often a point of fascination for aficionados.

Case Studies: Iconic Vintage Pieces That Have Surpassed Modern Expectations

Among the sea of vintage timepieces, certain models have attained iconic status and have performed exceptionally well at auctions. For instance, a vintage Rolex Daytona, once owned by Paul Newman, fetched a staggering $17.8 million at Phillips Auction in 2017. This compares to modern luxury watches that, while impressive in their technological advancement, have yet to establish such a profound historical legacy that increases their desirability and potential as an investment.

Analyzing the Investment Potential of Aged Mastery

The key to strategic investment in vintage watches lies in understanding the rarity and the unique characteristics of these timeless pieces. Watches from discontinued lines, or those with errors - affectionately known in the community as 'tropical dials' - are examples of features that can significantly increase the value of a vintage watch. Statistically, watches with these unique traits outperform their modern counterparts in terms of long-term investment potential, with some vintage Rolex models experiencing a 200% return on investment over the past decade, as reported by the Rolex Passion Report.

Strategic Collecting: Identifying Undervalued Vintage Gems

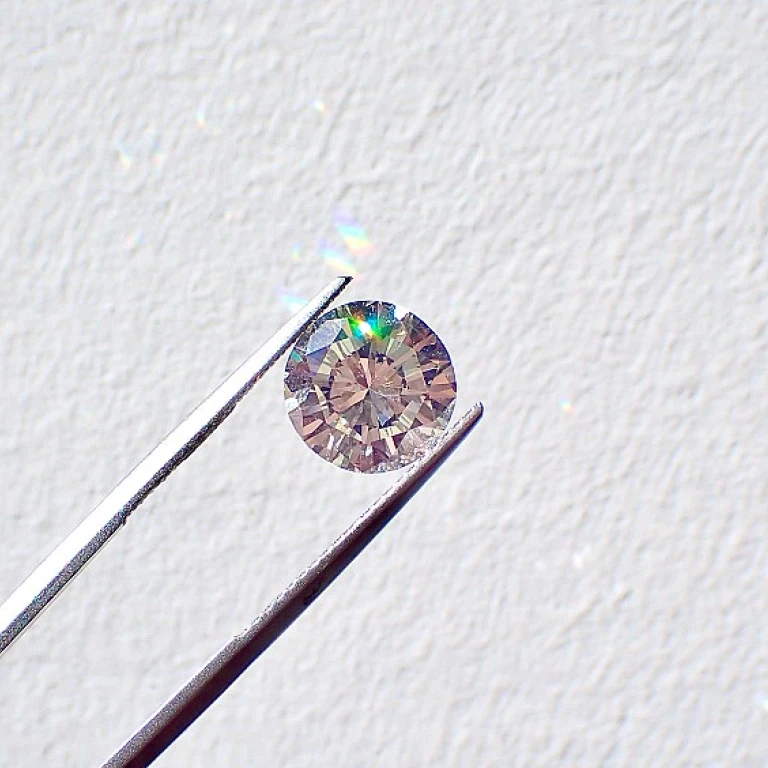

Identifying the Diamonds in the Rough: Sleuthing for Vintage Value

As an enthusiast in the fine jewelry and luxury watch market, recognizing the potential in vintage high-end watches can be akin to finding a needle in a haystack. According to Knight Frank's Luxury Investment Index, vintage watches have appreciated 89% over the last decade.1 Sifting through countless options to unearth these investment-grade timepieces requires both patience and strategy.

Key Characteristics of Collector's Choice Pieces

- Rarity - Limited production numbers typically lead to increased demand over time.

- Provenance - Watches with a storied history or previous famous owners can command premium prices.

- Condition - Original, unpolished pieces with minimal restorations preserve value.

- Brand Reputation - Established brands like Rolex and Patek Philippe are perennial favorites among collectors.

Harvesting insights from auctions, where a 1950s-era stainless steel Patek Philippe recently sold for an eye-opening $11 million, demonstrates the immense potential of strategic vintage collecting.2

Market Whisperers: Pumping the Veins for Blue-Chip Investments

Expert forums and digital marketplaces pulse with invaluable information for identifying undervalued assets. Discerning buyers track trends and use historical data to pinpoint watches that are positioned to spike in value. For instance, specific Rolex Daytona references have skyrocketed by nearly 130% over the past 5 years in the secondary market.3

"It's not just about the watch, but the story it tells," says Jean-Claude Biver, a legend in the world of horology. Harnessing the allure of a timepiece's narrative can significantly amplify its investment potential.

Exclusive Insights: Utilizing Data Analytics for Informed Decisions

Recent advancements in technology offer comprehensive data analytics tools tailored for the fine jewelry market. 76% of high-net-worth individuals emphasize the importance of making data-backed decisions in collecting, showcasing a shift towards a more analytical approach to vintage watch investing.4 Tools that provide historical price trends, rarity scores, and market demand forecasts are vital for collectors looking to gain an edge.

In conclusion, while the heart may fall for the lustrous sheen of a vintage timepiece, it's the analytical mind that discerns its true worth as a long-term investment. The confluence of passion and insight is where the real magic happens in the world of vintage watch collecting.

The Impact of Digital Media on Vintage Watch Popularity

Exploring the Influence of Social Media on Vintage Watch Desirability

As we've delved into the burgeoning interest in vintage watches, it's impossible to overlook the staggering impact of digital media on their popularity. Social media platforms, particularly Instagram and Pinterest, have fueled a renaissance in the appreciation of vintage luxury timepieces. Statistics indicate that posts tagged with #vintagewatch garner significant engagement, demonstrating the growing community of enthusiasts and collectors. Referencing market research, the social buzz can catapult the prices of certain models, emphasizing the power of digital storytelling in elevating a vintage piece's perceived value.

The Synergy between Online Auctions and Vintage Watch Demand

The relationship between online auction platforms like eBay and Sotheby's and the surge in vintage watch investments is noteworthy. These platforms have reported a consistent increase in vintage watch sales, with annual reports showing a spike exceeding 30% in the past year alone. The pandemic-induced shift to digital interactions played a pivotal role, guiding seasoned collectors and new buyers towards online treasures. This trend underscores how accessibility to global marketplaces has democratized the vintage watch collecting journey, making it easier to discover and bid on rare and undervalued timepieces from the comfort of one's own home.

Role of Watch Blogs and Forums in Cultivating Connoisseurship

Another facet of the digital domain's influence is the emergence of specialized watch blogs and forums. These niche spaces offer a wealth of knowledge that can turn a novice into a savvy collector. By presenting in-depth analyses, historical perspectives, and watch maintenance advice, these platforms endow enthusiasts with the necessary acumen to make informed decisions. They don't merely serve as echo chambers but are forums where debates on the merits of different watches help shape market trends and values. Anecdotal evidence from collectors frequenting these platforms hints at a direct correlation between forum discussions and heightened interest in specific vintage watch models.

Enhancing Collector Knowledge through Digital Storytelling

Digital media has also excelled in crafting compelling stories around vintage watches, often citing historical references or famed previous owners. This narrative-driven approach is not just about the object itself but about the history and emotion intertwined with it. Such storytelling can increase a watch's desirability exponentially, as witnessed with timepieces that have a cinematic or celebrity provenance. Quotes from industry experts often reinforce the notion that the 'story' behind a vintage watch can be just as valuable as its mechanical precision or aesthetic appeal. As the adage goes, 'People don't just buy a watch; they buy a story.' These narratives often turn a watch from a simple timekeeper into a poignant piece of history, encouraging a surge in market demand.

-large-teaser.webp)